Heading into the holiday seasons means one thing for compensation professionals — gearing up for the 2022 compensation cycles. And, a big part of that is establishing the budget for annual pay increases.

Over the last several years, this has been largely a “rinse and repeat” process for compensation teams as budgets have remained steady at 2.5% to 3% — and early indicators based on the August Pulse of the market indicate that is likely to be the case again. But pressures have continued to mount over the past several months with both inflation and quit rates being at 20-year highs. This has resulted in many employers taking a harder look at compensation plans for 2022.

So, are compensation budgets trending up?

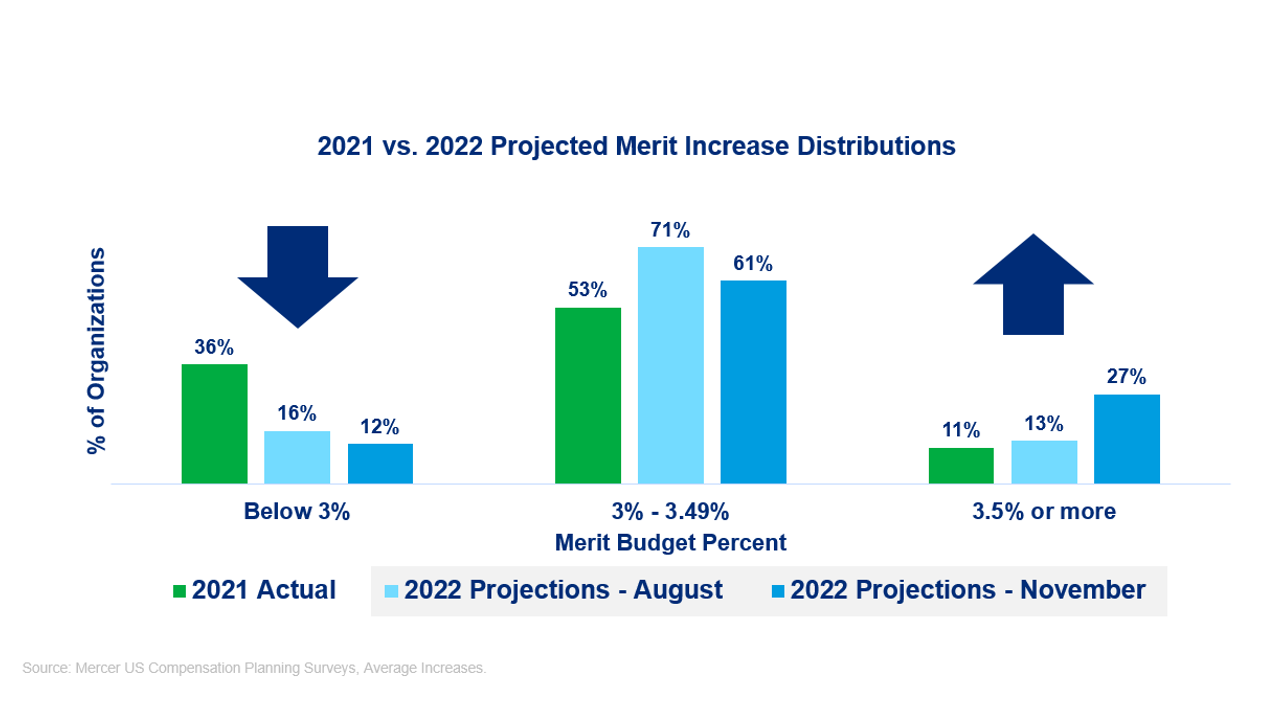

Based on insights from more than 950 employers, compensation budgets are going up, but only slightly. Merit increase budgets are tracking at 3.2%*, while total increase budgets, which also include other types of budgeted base pay increases, such as promotion awards, are tracking at 3.5%. This is up just slightly from 2022 projections of 3% and 3.3%*, respectively, from our August Pulse — and an increase over 2021 actual increases of 2.8% merit and 3%* total increase budgets. While still representing a minority of employers, the percentage of employers providing increases of 3.5% or more doubled between the August and November pulses – from 13% to 27%.

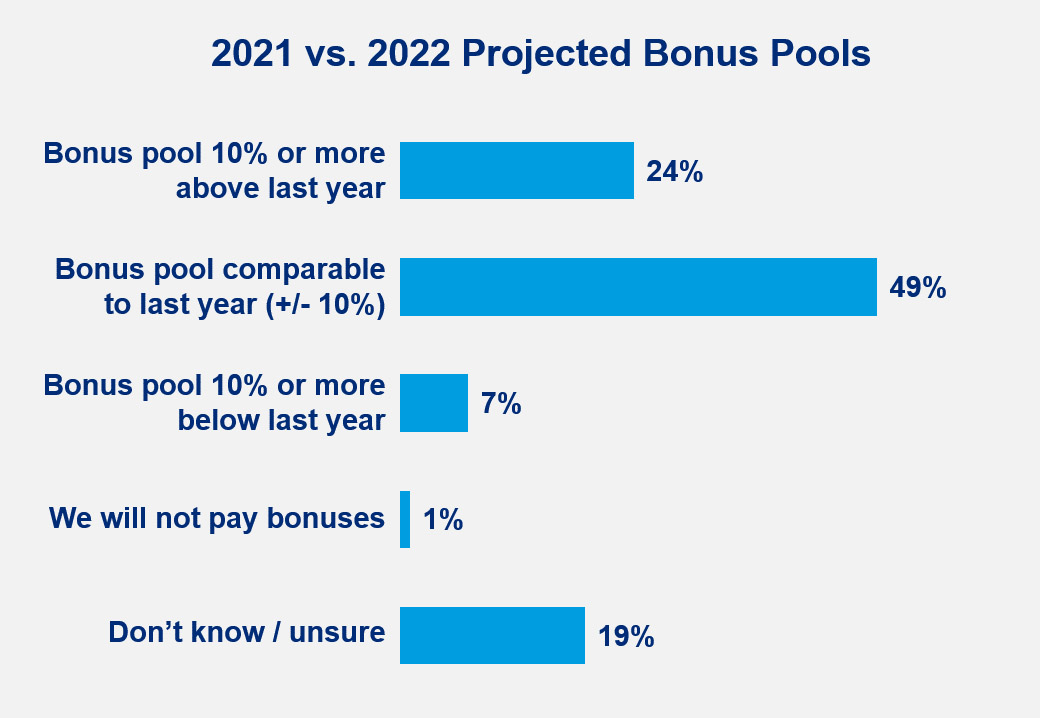

It’s worth noting that incentive payouts are looking to be strong relative to last year, as 1 in 4 employers say they will have an overall bonus pool more than 10% higher than last year. Nearly half of employers say the bonus pool will be comparable to that of last year (within ± 10%), while only 7% say it will be more than 10% less than last year, 19% say they aren’t sure, and 1% say they will not pay bonuses.

Source: 2021 Compensation Planning Pulse Survey

So, back to 3% and we’re all set, right?

The reality is that budgets are not yet baked. The majority of employers do not provide increases until March or April, and as we saw during earlier stages of the pandemic, employers are going to defer decisions until the latest point possible. Of more than 950 respondents, nearly half of employers said their budgets are still preliminary, a third of employers have proposed their budget to leadership and only 20% say they have been approved by leadership. So the reality is that these numbers may still change, particularly with the economic uncertainty surrounding Omicron.

While this data is useful to understand the expected broad market movement, compensation budgets should be handled the same as any other multi-year strategic investment — and require a deeper examination of the organization’s circumstances.

Most organizations are struggling to attract and retain the talent they need. With extensive media coverage about the labor market and inflation, employee expectations are still running high. And, with 10.4 million open jobs, the tough reality is, at the moment, most employees would likely have no trouble finding a new role – and likely command a premium for job switching.

So what can you do?

1. Prioritize your hourly workforce

Our research has shown that this is the segment of the workforce driving the continued attrition in the workforce — and wages are moving fast. Keep in mind that annual merit budgets do not take into consideration other types of increases. Of employers reporting, 37% have increased their internal minimum wage since March 1 for at least some positions and another 5% are considering doing so before the end of 2021. BLS data shows year-over-year average hourly earnings have increased by 4.9% — so if you haven’t already addressed your starting wages for your hourly workforce, now is the time.

2. Seal the cracks

Merit budgets have a tendency to be spread like peanut butter. This often means that gaps in pay competitiveness are not addressed and there are pockets within the organization at the employee, job, or function level where pay is falling short.

Below-market compensation presents a talent-retention risk in a hot job market. It also means that organizations may be more likely to resort to off-cycle increases outside of the merit process — for which 3 out of 4 organizations do not budget. Failure to proactively address these gaps in competitiveness can lead to increased turnover, higher spending, and potential pay equity concerns when increases are distributed outside the process (and generally to those who make the most noise).

Organizations should ensure that their merit budgets are sufficient enough to close gaps in competitiveness — and also ensure that the budget is distributed where it’s most needed. That may mean a segmented approach that considers critical business segments, high performers, and/or those below market.

3. Don’t forget the broader employee experience

While pay matters, a lot, in many cases it’s when the broader employee experience falls short that employees will start to shop their options. Employees are feeling exhausted and burnt out from the pandemic, and that is leading to a great reckoning about work. While pay is important, don’t lose sight of the bigger picture. Examine ways you can support your workforce with their unmet needs, deliver higher quality jobs, and create more supportive flexible environments.

As we continue to navigate this unprecedented labor market, the pressure will be on for compensation departments. Now is the time to double-down on your strategy and target your investments where they will deliver the most value to your business.

* All data reported represent averages and include zeros (i.e., companies that did not provide merit, or are not planning to provide merit, are included in the totals).

***** ***** ***** ***** *****

Source: Mercer

https://www.mercer.us/our-thinking/career/compensation-is-going-up-but-is-it-enough.html