MARCH 28, 2022 by RICHARD FRY

Women in the United States continue to earn less than men, on average. Among full-time, year-round workers in 2019, women’s median annual earnings were 82% those of men.

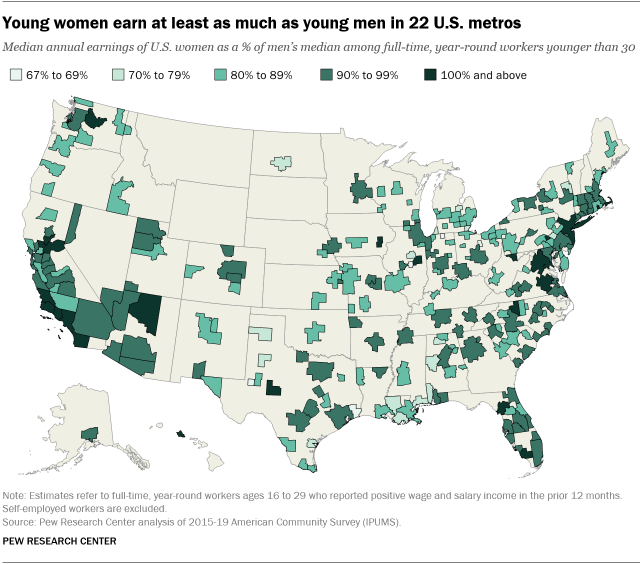

The gender wage gap is narrower among younger workers nationally, and the gap varies across geographical areas. In fact, in 22 of 250 U.S. metropolitan areas, women under the age of 30 earn the same amount as or more than their male counterparts, according to a new Pew Research Center analysis of Census Bureau data.

How we did this

Men in the United States have long earned more than women, on average, but this gender wage gap has slowly narrowed over time. The gap tends to be smaller among younger workers. This analysis examines the extent to which the gender wage gap among young workers also varies across metro areas.

The analysis is based on the American Community Survey (ACS), the largest household survey in the U.S., with a sample of more than 3 million addresses. It covers the topics previously covered in the long form of the decennial census. The ACS is designed to provide estimates of the size and characteristics of the nation’s resident population, which includes persons living in households and group quarters.

The specific 2015-2019 five-year ACS microdata sample used here was provided by the Integrated Public Use Microdata Series (IPUMS) from the University of Minnesota. IPUMS assigns uniform codes, to the extent possible, to data collected in the ACS.

The 2019 ACS data is the most recent available. The collection of the 2020 data was severely impacted by the COVID-19 pandemic.

Based on the 2010 census, the U.S. Office of Management and Budget delineated 384 metropolitan statistical areas. The IPUMS ACS provides information on 260 metros. As explained in the documentation for MET2013, there is an imprecise correspondence between the metro boundaries in the ACS data and the official metro area boundaries. This analysis uses information for only 250 metros because 10 metros had an insufficient number of young full-time, year-round working women living in them to provide accurate estimates.

A “full-time, year-round worker” worked at least 50 weeks in the year prior to the interview date and usually worked at least 35 hours per week. Among women workers under 30, 43% work full time, year-round.

Recent Pew Research Center analyses of the gender pay gap examine the median hourly wage of both full- and part-time workers using the Current Population Survey (CPS). The CPS does not provide information on individual metropolitan areas. The CPS and ACS provide similar estimates of the gender pay gap for the U.S. Using the CPS, the Census Bureau estimates that the gender earnings gap for full-time, year-round workers ages 15 and older was 82% for 2019, matching that derived from the ACS.

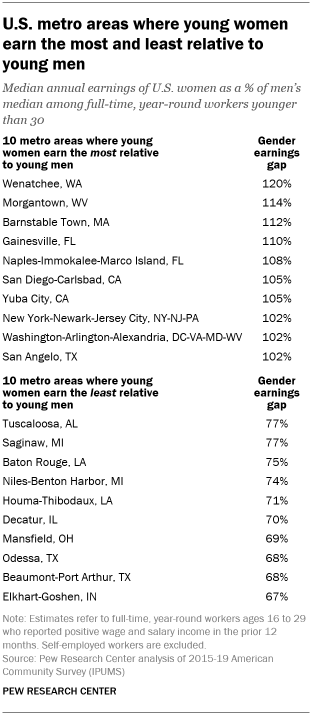

The New York, Washington, D.C., and Los Angeles metropolitan areas are among the cities where young women are earning the most relative to young men. In both the New York and Washington metro areas, young women earn 102% of what young men earn when examining median annual earnings among full-time, year-round workers. In the Los Angeles-Long Beach-Anaheim metro area, the median earnings for women and men in this age group were identical in 2019. (For data on earnings and the gender gap for 250 U.S. metropolitan areas, read this Google sheet.)

Overall, about 16% of all young women who are working full time, year-round live in the 22 metros where women are at or above wage parity with men.

There are 107 metros where young women earn between 90% and 99% of what young men earn. Nearly half (47%) of young women working full time, year-round lived in these areas in 2019.

In another 103 metros, young women earn between 80% and 89% of what men earn. These areas were home to 17% of young women who were employed full time, year-round in 2019.

And in 14 metros, young women’s earnings were between 70% and 79% those of men in 2019. About 1% of the young women’s workforce lived in these metros.

In four metro areas – Mansfield, Ohio; Odessa, Texas; Beaumont-Port Arthur, Texas; and Elkhart-Goshen, Indiana – women younger than 30 earn between 67% and 69% of what their male counterparts make. These metros account for 0.3% of the young women’s workforce. (Some 19% of young women in the workforce are employed in metros where earnings data is not available or are in nonmetropolitan areas.)

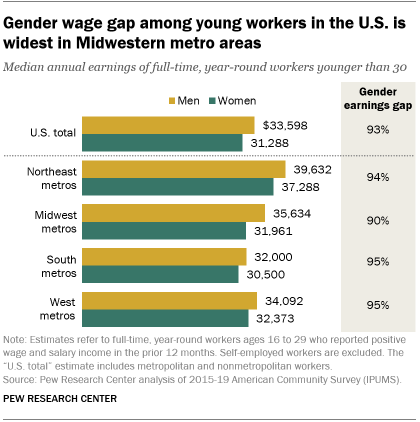

From a regional perspective, metropolitan areas in the Midwest tend to have wider gender wage gaps among young workers. Young women working full time, year-round in Midwestern metros earn about 90% of their male counterparts. In other regions, by comparison, young women earn 94% or more of what young men earn.

Nationally, women under 30 who work full time, year-round earn about 93 cents on the dollar compared with men in the same age range, measured at the median. As these women age, history suggests that they may not maintain this level of parity with their male counterparts. For example, in 2000, the typical woman age 16 to 29 working full time, year-round earned 88% of a similar young man. By 2019, when people in this group were between the ages of 35 and 48, women were earning only 80% of their male peers, on average. Earnings parity tends to be greatest in the first years after entering the labor market.

Labor economists examine earnings disparities among full-time, year-round workers in order to control for differences in part-time employment between men and women as well as attachment to the labor market. However, even among full-time, year-round workers, men and women devote different amounts of time to work. Men under 30 usually work 44 hours per week, on average, compared with 42 hours among young women.

Note: For data on earnings and the gender gap for 250 U.S. metropolitan areas, read this Google sheet.

***** ***** ***** ***** *****

Source: Pew Research Center

https://www.pewresearch.org/fact-tank/2022/03/28/young-women-are-out-earning-young-men-in-several-u-s-cities/