Many state and local legislatures are banning employers from asking job candidates about their past pay—and salary negotiations may never be the same.

By Susan Milligan

Feb 16, 2018 |

"And what’s your current salary?”

For as long as many HR professionals and job seekers can remember, that question has been asked and answered almost reflexively during initial hiring discussions. It gives an employer critical early information. Applicants who earn more than the amount budgeted for the job can be screened out right away. Those making much less can be snapped up at a bargain, while still enjoying a salary bump.

But recently, policymakers have been rethinking the wisdom of this query, given the role it may play in perpetuating gender and racial disparities in compensation. The gender pay gap remains stubbornly wide, with women earning around 80 cents to a man’s dollar. Black and Latina women see the biggest discrepancy, bringing in around 60 cents and 55 cents, respectively, for every dollar earned by white men.

That’s why a number of state and local legislators, including those in California and New York City, are moving to ban questions about job candidates’ salary histories. “If you keep asking the compensation question, you’re going to exacerbate the issue,” says Dawn Hirsch, chief human resources officer at HireRight, a New York City-area employment background screening firm. In other words, the question institutionalizes and perpetuates the salary differential each time those who have experienced pay discrimination change jobs, she argues.

“Gender pay inequality will go on forever if we don’t do something,” says former HR director Susie Clarke, now director of undergraduate career services at Indiana University’s Kelley School of Business.

Yet many HR leaders aren’t buying it, so to speak. A survey by the Hay Group consulting firm found that nearly two-thirds of chief human resource officers and other corporate executives surveyed believe the restriction will do little to improve pay equity.

Be that as it may, salary history bans appear to be changing HR’s long-standing practice of asking candidates about past pay. Whether you work in a jurisdiction prohibiting the question or not, it may be time to revisit your hiring practices and compensation strategies—relying more on market data to set pay, focusing on a candidate’s qualifications or instituting new nationwide policies, for example.

If you’ve long relied on salary history during negotiations, you might feel like you’re at a disadvantage at first. But consider this: Past salaries may not have been the right benchmark for setting compensation to begin with, many experts say, casting doubt about the wisdom of inquiries regarding past compensation.

“They should be banned,” says veteran HR manager Pamela Harding, SHRM-SCP, CEO of Metzano in Enumclaw, Wash., which manages social media groups for HR specialists, including the Linked:HR group on LinkedIn. “You should not be asking salary, current or otherwise. But not because of a real or perceived reasoning for why a female is not making as much or a black person is not making as much,” she says. “The reasoning is because no one should be making a decision based on salary. You should be making a hiring decision based on aptitude and experience.”

No-Haggle Pricing

Like all business professionals, hiring managers are constrained by budgets, and they want to get the best bang for their buck every time they bring someone on board. They’ve traditionally relied on past salaries as a yardstick for gauging the minimum they could pay a candidate. Some employers go so far as to request W-2s to confirm a person’s salary, says Craig Fisher, head of global marketing for Allegis Global Solutions, a Hanover, Md.-based staffing and recruitment firm.

Yet that approach makes individuals’ personal work histories—rather than the value of a particular job to the organization—a top determining factor for setting compensation, which some experts and legislators say is illogical at best and potentially discriminatory at worst. That’s why it’s best to negotiate salary in other ways, such as by asking a candidate what his or her expectations are, to avoid making pay gaps worse, Fisher says.

But doing so―essentially, asking job candidates to blink first and name what they’d like to make—doesn’t always seem to be the best approach either. Research suggests that women may lowball their own salary asks. At the same time, it’s important for hiring managers to get an idea early on of whether the company and the candidate can reach an agreement on compensation.

One way for employers to do that is to be more transparent about how they value each position. Take Colorado Springs Utilities in Colorado Springs, Colo., for example, which employs 1,800 people. It included the question about past pay on its application until the summer of 2017, says Jonathan Liepe, SHRM-SCP, the utility’s human resources supervisor. Now, the organization advertises an expected pay range for each job and has a “no-haggle/low-haggle” approach that takes into account an applicant’s experience, licenses and education as they relate to the job. “To me, it’s steeped more in sound HR principles than having a law in place,” Liepe says.

The HR team and hiring managers at Alameda Electrical Distributors in Hayward, Calif., have never asked candidates about their past salaries, relying instead on the going rate for the job. “We put a lot of work into our compensation plans. We do market research and get really good data. I don’t need to know about somebody’s last [salary] to offer a fair rate of pay,” says Erin Dangerfield, SHRM-CP, HR director at Alameda. “We’re looking at it constantly. If the world changes, that changes the pay rate.”

Focus on Skills

Indeed, the work world is evolving more rapidly than ever, with demand constantly shifting to encompass new competencies. That’s why benchmark salary data should be based not on job titles but on skills—which change rapidly with technology and other fluctuations in the business environment, says Catie Brand, director of talent acquisition at General Assembly, a New York City-based technology school.

Instead of looking at what an applicant is earning, pay attention to the skill set the person has and how relevant it is to the job being filled. “Companies need to figure it out beforehand. It’s going to put more of a burden on the organization for each position they’re hiring for―what do they want to pay?” says labor and employment lawyer Cindy Minniti, managing partner of the New York office of Reed Smith.

Today’s job candidates view pay differently as well. Some people are willing to earn less, for example, in exchange for more-flexible schedules, easier commutes or other benefits. Many Millennials and others may change positions, and even careers, frequently and no longer assume (if they ever did) that compensation should be tied to longevity or previous pay, says Carisa Miklusak, CEO of the recruitment firm tilr, a New York City-area company that uses an algorithm to help employers match skills to job requirements instead of job titles. “We see the demand from employees. They want to be paid based on their skills, even if they don’t have 20 years of experience. We’ve seen this overall shift in values in the workforce.”

Legal Uncertainty

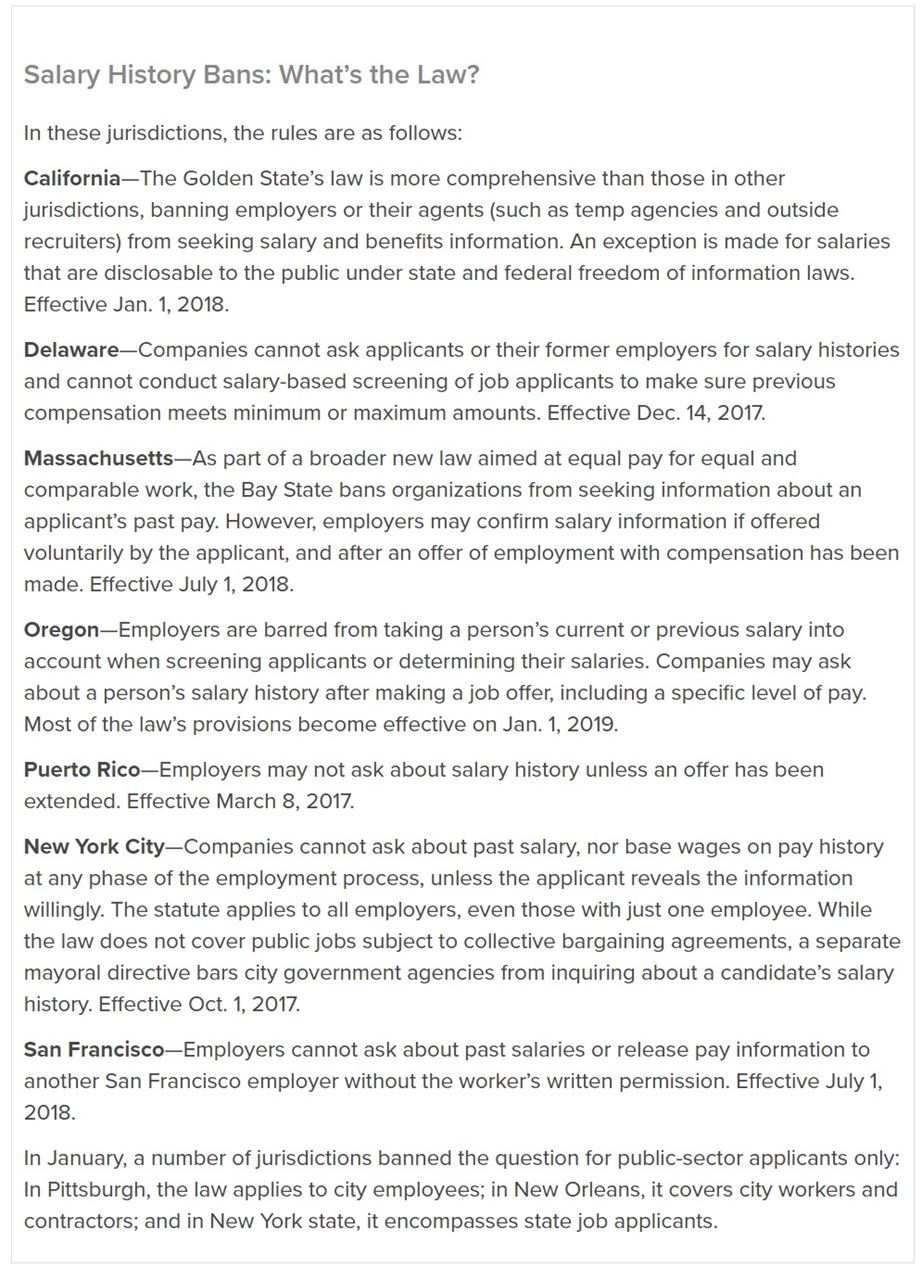

The legal landscape is still uncertain and the laws vary, even as many companies are moving away from asking about salary histories as a best practice. For example, New York City bans public and private employers from inquiring about a person’s previous compensation during any phase of the hiring process, though they can ask the question after an individual has been hired at an agreed salary. Other jurisdictions, such as Delaware, Oregon and Massachusetts, allow employers to confirm previous salaries, but only after an offer has been made (including a specific offer of compensation) to the applicant. Pittsburgh’s statute and a few others apply only to public employees.

Instead of looking at what an applicant is earning, pay attention to the skill set the person has and how relevant it is to the job being filled.

Penalties run the gamut as well. In New York City, infractions are a violation of the city’s human rights law. That means employers could be required to pay damages and penalties of up to $250,000 and undergo mandatary training about the law. Delaware’s legislation imposes civil penalties of up to $10,000 for each infraction.

Hiring could get even more complicated, depending on how the laws are interpreted by the courts, says Joseph Kroeger, a labor and employment lawyer with Snell & Wilmer in Tucson, Ariz. For example, an applicant could argue that companies that ask for salary histories―even if their own jurisdiction allows it—are violating the federal Equal Pay Act because of the “disparate impact” of the legislation. In other words, if women in one place are protected by a law aimed at closing the gender pay gap, while those someplace else aren’t, it’s a form of discrimination, by impact if not design.

In Philadelphia, the local Chamber of Commerce is opposing the city’s salary history ban law in court, arguing that it violates the constitutional right to free speech without providing clear evidence that it will solve the problem of unequal pay. The Philadelphia statute has been stayed pending resolution of the case, and if courts ultimately rule in the chamber’s favor, laws in other jurisdictions could face similar challenges.

Next Steps

In the meantime, here’s what HR and legal experts advise when implementing a ban on asking job candidates about their salary histories:

Know the law. As obvious as that sounds, “labor and employment laws are constantly changing, and many are locally introduced, so unless you have a finger on the pulse of local legislation, you can easily miss important changes,” says Robert Manfredo, a labor and employment lawyer with Bond, Schoeneck & King in Albany, N.Y. HR leaders in companies with offices in different states or municipalities need to learn which legislation affects them. Further, in recent years the New York State Attorney General’s office has held employers responsible for what supervisors have said at job fairs, Manfredo says, so your entire hiring team needs to be aware of the law.

Change your mindset about compensation and negotiation. This may be particularly tough, since many hiring managers rely on the “false sense of security” that comes with offering a candidate a modest salary hike, says Beth Conway, vice president of HR at CA Technologies North American in the Boston area. It means making sure everyone from recruiters to hiring managers, supervisors and HR are on board with aligning salaries to a new employee’s worth to the company―and not to what a previous employer paid.

Figure out the salary range for each job, and consider sharing pay bands with applicants.(California requires that.) Be very clear in job descriptions, and update them regularly.

Conduct competitive market analyses. Use data to find out what other businesses are paying for a particular job and skill set, and stay up-to-date on market rates.

Ask applicants what their salary expectations are. The answer can help screen out, early on, candidates whose salary demands are well outside the range of what an organization is willing to offer. (Be aware, though, that research suggests that women may lowball their own salary asks.)

Train hiring and management personnel. Doing this helps ensure that they are not inadvertently asking the salary history question. Continue to hold periodic training to make sure everyone is updated on rule changes, and distribute memos reminding people of the law. Document training by requiring managers to sign statements confirming their participation. This can be critical if a company is sued, says Mineola, N.Y.-based attorney Christopher P. Hampton. That would enable the organization to show it was an individual’s mistake if the question is asked, and not a systematic failure.

Modify all paperwork to comply with the bans. That includes the written application, the employee handbook, and the interview scripts for recruiters, managers and HR, counsels Michael Schmidt, vice chair of the labor and employment department in the New York City office of Cozen O’Connor. Ensure that there is no reference to salary history, “even if it’s couched in bells and whistles that make it look voluntary,” Schmidt says.

Most of all, don’t wait around to change your hiring strategies simply because your state or city has not banned salary history questions. Many large organizations are likely to get out in front of the issue by changing their national policies and complying with the most stringent legislation enacted, according to the Hay Group survey. “Get ahead of the game,” Fisher urged, “because it’s coming everywhere.”

***** ***** ***** ***** *****

Source: Society for Human Resource Management (SHRM)

https://www.shrm.org/hr-today/news/hr-magazine/0318/pages/salary-history-bans-could-reshape-pay-negotiations.aspx